- Dated 23/08/23 – Fund Update

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the Aurora Absolute Return Fund (ABW), Aurora Dividend Income Trust (ADIT), Aurora Fortitude Absolute Return Fund (AFARF), Aurora Global Income Trust (AIB), Aurora Property Buy-Write Income Trust (AUP) and HHY Fund (HHY) (collectively the Funds) provides the following market update, where applicable, in relation to the Funds’ investments in RNY Property Trust (RNY) and Molopo Energy Limited (Molopo).

This Fund Update is supplementary to, and should be read in conjunction with, the earlier Fund update provided on 23 February 2023.

RNY Property Trust update

RNY Property Trust (RNY) is an Australian unlisted property trust with five (5) commercial property assets located in the tri-state area of New York, USA, with 3 properties located in Long Island and 2 properties located in Westchester County, collectively having 830,000 sq feet of lettable office space. Huntley Management Limited is the responsible entity for RNY and Aurora Funds Management Limited is the investment manager.

In August 2021, RNY’s US lender to RNY Australia Operating Company (US LLC), ACORE Capital (‘the Lender’), advised that it would not extend the Loan facility through to October 2022, as contracted, as the Lender considered that documents relating to the net worth test were not administratively executed to its satisfaction and constituted an event of default. Aurora refutes the position adopted by the Lender and notes that the Lender nonetheless continues to rely upon the documents.

In late 2022, the Lender took steps to enforce its security by seeking to commence foreclosure action, seeking to appoint a receiver, and selling the mezzanine debt in the US properties through a Uniform Commercial Code (UCC) auction process. ACORE also advised that default interest of circa US$11 million was due under the loan, however provided no formal paperwork to support this was claim. The UCC auction process was ultimately cancelled after RNY’s related entity, RAOC, acquired the mezzanine debt and paid the associated fees (circa US$1 million).

In March 2023, the Supreme Court of the State of New York County of Nassau (in Long Island) appointed a Rent Receiver over the five RNY properties, being a party independent of the party nominated by the Lender. The Rent Receiver posted a bond and filed an Oath with the Court around 11 April 2023, thereby formalising his appointment. Notwithstanding this appointment, CBRE continues to manage the RNY properties.

Based on recent discussions with the Rent Receiver:

The strong leasing activity and Letters of Leasing Intent at Tarrytown prior to the Rent Receivers appointment, as mentioned in the last Fund Update of 23 February 2023, have not materialised and no new leases have been executed since March 2023; and

The Rent Receiver’s remuneration is based on a % of cash receipts and expenditures (including operating costs and capital expenditure) rather than a time-based arrangement.

Aurora denies that the Group was in breach of the loan obligations and continues to defend the enforcement actions taken by the Lender. In the meantime, the additional expenses associated with the Rent Receiver represent a permanent diminution in value for RNY unitholders.

RNY owns 100% of RNY Australia LPT Corp (Maryland REIT) which in turn owns 75% of RNY Australia Operating Company LC (US LLC), which in turn owns the five RNY properties in separately held subsidiaries. Aurora and parties associated with it, including its Funds, own 79.9% of the units in RNY, with Keybridge Capital Limited (ASX: KBC) holding 17.3% and the remaining unitholders holding 2.8%.

Since the last Fund Update, attempts have been made to resolve the deadlock situation with the Lender. Until this matter is satisfactorily resolved, and a new debt facility can be agreed, there is significant uncertainty regarding the valuation of the subordinated loans and equity interests in RNY.

The Lender has, on several occasions, expressed interest in taking over ownership of the RNY properties, however, has stated that it would only be prepared to offer token consideration.

Based on the uncertainty created by the Lenders actions as outlined above, including unsupported claims for default interest, the Aurora Board considers it appropriate to fully impair to nil the carrying value of its equity investments in RNY and the subordinated loans it has advanced to RAOC, until such time as the impasse with the Lender can be resolved.

The fair value of the RNY equity investments and subordinated loans is based on significant estimates and judgements adopted by the Board of Aurora based on all available information about RNY as at the current date. The Aurora Board is aware of the material impact this decision will have on Aurora and its Funds.

Further, Aurora notes that RNY’s second largest unitholder, Keybridge, has fully impaired the carrying values of its 17.3% equity investment in RNY as well as the subordinated loan it advanced to RAOC (which was used to acquire the mezzanine debt in the US properties). Keybridge has stated that the recoverability of its interests in RNY is dependent upon the prevailing market value of the underlying US properties less the senior debt. Further, given the state of the broader market, expectations on property values and the status of the dispute with RNY’s Lender, Keybridge considers its subjective valuation to be appropriate.

The Aurora Board considered the range of possible values and determined that the fair value of the RNY equity investments and subordinated loans held by Aurora and its Funds should now be valued at nil.

Aurora will continue to pursue its options to resolve the deadlock with the Lender.

Molopo Energy update

In a letter to shareholders, dated 2 May 2023, Molopo Energy Limited (Molopo) advised “the Company has approximately AUD$16.9 million in cash and a debt owing to Molopo from a subsidiary of Renergen Limited of approximately AUD4.2 million which has preconditions to its payment and, from 1 January 2023, now accrues interest.”

Further, it added that “as foreshadowed at last year’s Annual General Meeting the Board’s focus has been concentrated on defending the long running Canadian proceedings against the Company’s subsidiary Molopo Energy Canada Limited (MECL) which were commenced in 2011. Since our meeting last year those proceedings are continuing and have now progressed through the discovery process and interrogation of witnesses which has been both detailed and time consuming.

The proceedings involve the claim for damages by 3105682 Nova Scotia ULC (310) against MECL and Crescent Point Holdings Inc and Crescent Point Energy Corp (Crescent Point) arising from the sale of the Company’s subsidiary’s oil and gas assets in 2011. Crescent Point has cross claimed against MECL in relation to potential losses it may incur. The claims for damages by 310 are significant and complex and are being strongly defended by both MECL and Crescent Point but again at significant expense to shareholders. It was anticipated that a court directed mediation would take place in April this year, however, the mediation has now been scheduled for the 5th and 6th December 2023 in Calgary.

The Board will continue to vigorously defend the proceedings.”

Aurora notes that the value of the Funds (AFARF/ABW and AIB) investment in Molopo was written down to nil during the year ended 30 June 2021. The Funds have not adjusted the carrying value of its investment as it is waiting on the outcome of other litigation matters that Molopo is involved in.

The Funds continue to adopt a carrying value of $nil per Molopo share. Aurora will re-assess the carrying value of its investment in Molopo based on further information being released by Molopo regarding its financial position.

Redemptions

Given the uncertainty created by the abovementioned matters, where applicable, Aurora considerers it prudent to maintain a temporary hold on Redemptions until the outcome of the above two (2) matters is known.

- Dated 07/08/23 – Board Changes

Aurora Funds Management Limited (Aurora) is pleased to announce that Mr Jeremy Kriewaldt has been appointed as a Non Executive Director of the Company.

Mr Kriewaldt is a lawyer in private practice, specialising in corporate and commercial law, including mergers and acquisitions, capital raisings and foreign investment, financial product development and securities markets. He started his own practice in 2018 and was previously a partner of Atanaskovic Hartnell (2004 – 2018), Blake Dawson Waldron (now Ashurst) (1990-2003) and served as Counsel to the Takeovers Panel in 2003-2004.

Mr Victor Siciliano who joined the Aurora Board in January 2018 has resigned as a Director of the Company. The Board would like to thank Mr Siciliano for his contribution to the Board during his tenure and wish him all the very best in his future endeavours.

- Dated 23/02/23 – Fund Update

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the Aurora Absolute Return Fund (ABW), Aurora Dividend Income Trust (ADIT), Aurora Fortitude Absolute Return Fund (AFARF), Aurora Global Income Trust (AIB), Aurora Property Buy-Write Income Trust (AUP) and HHY Fund (HHY) (collectively the Funds) provides the following market update, where applicable, in relation to the Funds’ investments in RNY Property Trust (RNY) and Molopo Energy Limited (Molopo).

RNY Property Trust update

RNY Property Trust (RNY) is an Australian unlisted property trust with five (5) commercial property assets located in the tri-state area of New York, USA, with 3 properties located in Long Island and 2 properties located in Westchester County, collectively having 830,000 sq feet of lettable office space. Huntley Management Limited is the responsible entity for RNY and Aurora Funds Management Limited is the investment manager.

On 6 October 2020, during COVID-19 (which greatly impacted New York city), Aurora closed a Loan Modification with RNY’s US lender, ACORE Capital (Lender) with a larger facility to fund certain planned capital works (as required by the Lender), with the following key terms:

-

- a three-year term – comprising an initial 6-month term, one six-month extension and two 12-month extension terms following the initial term;

- interest only;

- an existing loan facility of US$76.2 million, with US$64.6 million having been drawn, leaving US$11.6 million available for approved capital expenditures and leasing costs;

- a new mezzanine loan facility of US$15.6 million to fund additional approved leasing costs and capital expenditures; and

- RNY to complete the approved capital expenditure program.

Through the course of 2022, the Lender made various overreaching demands of RNY, including multimillion dollar claims for fees, which Aurora disputes, and demands that all the buildings be sold in an accelerated manner, for total sale consideration that would have amounted to circa US$92 million.

Separately, Aurora worked with an alternate financier (being a Tier 1 financier) to refinance the 3 Long Island properties (representing approximately two thirds of the portfolio’s lettable area), based on a signed Term Sheet for US$60 million of debt finance (before reserves) on those properties at prime lending rates (locked for 10 years in March 2022). The valuations obtained for the three Long Island properties, in an orderly market, to support this alternative financing exceeded US$90 million.

In addition, based on comparable recent sales of properties in the Westchester area, the value of the remaining 2 RNY properties (in Westchester) is in the vicinity of US$30 million, with these buildings having benefited from circa US$7 million of recent capital improvements.

In late 2022, the Lender took steps to enforce its security by seeking to commence foreclosure action, seeking to appoint a receiver, and selling the mezzanine debt in the US properties through a Uniform Commercial Code (UCC) auction process. This UCC process has the result of transferring the equity in the properties to purchaser of the mezzanine finance (which in this case totalled just US$1.7 million). The UCC auction process was ultimately cancelled after RNY’s related entity, RAOC, acquired the mezzanine debt and paid the associated fees (circa US$1 million).

Aurora is actively defending any enforcement actions taken by the Lender, and engaged US Counsel in June 2022 to assist. In addition, Aurora is working to resolve the deadlock situation with the Lender. Until this matter is satisfactorily resolved, and a new debt facility can be agreed, there is significant uncertainty regarding the valuation of the subordinated loans and equity interests in RNY.

RNY Leasing

Following the substantial capital works program, Aurora is encouraged by the current levels of improved leasing velocity. Aurora is however cautious given the current turbulent economic conditions and interest rate environment; and remains optimistic with the short to medium term prospects of the Portfolio. Furthermore, Aurora is pleased with the retention of its current tenants, with minimal reduction in the portfolio occupancy since the on-set of COVID.

Some recent new leasing highlights include:

-

- Full floor tenant (22,128 sq ft) signed with high-credit tenant on commercial terms at Westchester County property.

- Letter of intent with second full floor tenant (circa 22,000 sq ft) at Westchester County property. Similarly high credit tenant on commercial terms. This lease is expected to be finalised in the short-term.

- Letter of intent with third full floor tenant (circa 23,000 sq ft) at neighbouring Westchester County property. Similarly high credit tenant on commercial terms. This lease is expected to be finalised in the short-term.

- Letter of intent with tenant (circa 10,000 sq ft) at Westchester Country property. Similarly high credit tenant on commercial terms. This lease is expected to be finalised in the short-term.

Aurora is diligently working to convert the above-mentioned leases into executed deals. If completed, these prospective leases should materially enhance the occupancy and financial characteristics of the Portfolio.

Molopo Energy update

On 17 December 2021, Molopo Energy Limited (Molopo) advised (on its website) that it had settled the legal action against the former Molopo directors for A$12 million. This equates to 4.8 cents per Molopo share (based on 249,040,648 shares on issue).

Aurora notes that the value of the Funds (AFARF/ABW and AIB) investment in Molopo was written down to nil during the year ended 30 June 2021. The Funds have not adjusted the carrying value of its investment as it is waiting on the outcome of other litigation matters that Molopo is involved in.

The Funds continue to adopt a carrying value of $nil per Molopo share. Aurora will re-assess the carrying value of its investment in Molopo based on further information being released by Molopo regarding its financial position.

Redemptions

Given the uncertainty created by the abovementioned matters, where applicable, Aurora considerers it prudent to maintain a temporary hold on Redemptions until the outcome of the above two (2) matters is known.

Yours faithfully

Aurora Funds Management Limited

John Patton

- Dated 08/06/22 – Delisted from the ASX / Market Update

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the

Aurora Property Buy-Write Income Trust (“AUP” of “Trust”), provides the following update to

unitholders regarding the current status of the Trust including future redemptions and/or

buy-backs.

RNY Property Trust

As of 31 December 2021, the Trust had loans receivable of $3,395,631 plus accrued interest

of $1,240,996 from RNY Australia Operating Company (“RAOC”) and RNY Property Trust

(“RNY”). The Directors consider the loans and accrued interest from RAOC and RNY to the

Trust to be fully recoverable and therefore there is no Expected Credit Loss associated with

these loans.

In addition, the Trust holds 218,783,206 units in RNY which are carried at 1.1 cents per unit,

equating to $2,406,615.

Future Redemptions

Aurora is mindful of the impacts on AUP’s liquidity following the cessation of trading on the

Australian Securities Exchange (ASX). Aurora is currently working on several initiatives to

enable AUP’s loans to be repaid, including the potential refinancing and/or sale of RNY’s

properties. Following the execution of these initiatives, AUP will endeavour to fund off-market redemptions, taking into consideration the liquidity of the Trust.

RNY Update

RNY’s portfolio has continued to maintain its occupancy at pre-pandemic levels, with

increased leasing interest being shown across properties. Furthermore, RNY has received

several unsolicited offers for its properties at values at least equal to current valuations.

RNY is currently considering these offers and will update RNY unitholders accordingly.

- Dated 30/09/20 – RNY Property Trust revaluation

Aurora Funds Management Limited (Aurora), in its capacity as the responsible entity of the Aurora Property BuyWrite Income Trust, Aurora Fortitude Absolute Return Fund, Aurora Global Income Trust and the Aurora DividendIncome Trust (Fund(s)), provides the following update in relation to the RNY Property Trust (RNY).

RNY has been suspended from trading on the Australian Securities Exchange (ASX) since 1 April 2019, due to delays experienced in finalising its audited financial statements for the year ended 31 December 2018 and half year ended 30 June 2019, followed by the Audit Disclaimer Opinion issued in relation to the year ended 31 December 2019. Aurora understands that RNY is due to release its Audit Reviewed financial statements for the half year ended 30 June 2020. In the event a clear audit review statement is issued, Aurora understands that RNY will then be in a position to apply for recommencement of trading on the ASX.

On 23 September 2019, RNY announced it had completed an independent valuation of its 5 commercial office properties in the New York tri-state area, resulting in a 16% uplift on previous valuations and a material uplift in RNY’s Net Tangible Asset (NTA) backing. Given RNY’s suspension from trading on the ASX, there was no actively traded market available for Aurora to determine the market value for RNY’s securities. As such, the independent valuation obtained by RNY was considered the most appropriate basis on which to determine the carrying value of RNY, with Aurora’s direct investments being carried at a small discount to RNY’s improved NTA.

On 29 June 2020, Keybridge Capital Limited (Keybridge) announced its intention to make an off-market all scrip takeover bid for RNY at an implied offer price of $0.011 per RNY unit1 (Keybridge Offer), with its Bidder’s Statement being dispatched on 28 August 2020. On 28 September 2020, Keybridge issued a substantial holder notice stating it had acquired a relevant interest of 1.01% in RNY (from parties other than Aurora) through acceptances into the Keybridge Offer. Aurora has also elected to accept a portion of its Funds holdings into the Keybridge Offer. Consistent with its previous “truth in takeovers” statement, Aurora has limited its acceptances into the Keybridge Offer at 41,450,000 RNY units.

As a consequence of the acceptances into the Keybridge Offer, the implied offer price of $0.011 per RNY unit is now the most readily observable price for RNY securities. As such, this has resulted in the carrying value of Aurora’s direct investments in RNY being reduced from $0.044 to $0.011 per RNY unit, across its various Funds.

Following the recommencement of trading in RNY securities on the ASX, Aurora will continue to adjust its direct investment in RNY to reflect the last traded market price.

This announcement was authorised for release by Aurora’s Managing Director.

- Dated 18/08/20 – Resignation of Joint Company Secretary and Change in Compliance Committee

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the HHY Fund (HHY), the Aurora Property Buy-Write Income Trust (AUP), the Aurora Global Income Trust (AIB) and the Aurora Absolute Return Fund (ABW), provides the following update as a result of ASX enquiries:

Mr Briglia’s role as Chief Financial Officer and Joint Company Secretary ceased on 1 April 2020 which coincided with the COVID-19 national lockdown measures introduced by the Australian Federal Government in March 2020. Mr Briglia’s financial responsibilities have been absorbed by Aurora’s existing finance, compliance and operations team, and Mr Patton has assumed sole responsibility for the Company Secretarial function (having been appointed as a Company Secretary on 29 November 2017).

Mr Patton also replaced Mr Briglia as the internal member of Aurora’s Compliance Committee, with the other two independent members being Mr Anthony Hartnell AM and Mr Patrick

Burroughs.

This announcement was authorised for release by Aurora’s Managing Director.

- Dated 02/04/20 – Suspension from Official Quotation

The securities of Aurora Property Buy-Write Income Trust (‘AUP’) will be suspended from quotation immediately under Listing Rule 17.2, at the request of AUP, pending ASX’s investigation.

- Dated 08/01/20 – Appointment of New Chief Financial Officer and Company Secretary

Aurora Funds Management Limited, as Responsible Entity the Aurora Property Buy-Write Income Trust announces that Mr Adrian Tilley has resigned as Chief Financial Officer and Company Secretary to take up a role in his family business in his regional hometown of South Gippsland, Victoria. The Board acknowledges the substantial contribution made by Mr Tilley during his tenure with Aurora and sincerely wishes him all the very best in his future endeavours.

Aurora is pleased to announce that Mr Mark Briglia has been appointed to the role of Chief Financial Officer and Company Secretary. Mr Briglia’s most recent role was as Chief Financial Officer and Group Manager, Australian Energy Market Operator. Mr Briglia has deep industry experience across a number of sectors at the executive level both in Australia and internationally. In addition, he is a Certified Practicing Accountant and holds a Master of Business Administration and a Bachelor of Commerce (University of Melbourne).

Mark will also replace Adrian Tilley as the internal member of Aurora’s Compliance Committee.

- Dated 03/05/19 – Distribution Policy Update

Aurora Funds Management Limited (AFSL 222110) (“Aurora”) as responsible entity for the Aurora Property Buy-Write Income Trust (“AUP” of “Fund”), provides the following update in relation to AUP’s Distribution Policy.

AUP currently pays quarterly distributions to unitholders, being the greater of 1.0% of its Net Asset Value (NAV) per quarter (4.0% per annum) or its distributable taxable income. Aurora hereby provides notice that it has elected to adjust the distribution policy for the Fund, such that the Fund will pay out its distributable taxable income on a semi-annual basis (in respect of the periods ended 30 June and 31 December each year) up to 1.0% of NAV per period (2.0% per annum). This change in distribution policy will take place following the 30 June 2019 quarterly distribution.

- Dated 10/10/18 – Temporary Amendment to Off-market Redemption Facility and Announcement of On-market Buyback

Aurora Funds Management Limited (AFSL 222110) (“Aurora”) as responsible entity for the Aurora Property Buy-Write Income Trust (“AUP” of “Fund”) provides the following update in relation to the Fund’s off-market redemption facility and a proposed on-market unit buy-back for up to 10% of the outstanding AUP units on issue.

Off-market Redemption Facility

On 22 March 2018, Aurora provided AUP unitholders with notice of a temporary modification in the Fund’s investment strategy, to allow investments in unlisted international property related equity and debt instruments, specifically in relation to the existing North American commercial property assets of RNY Property Trust (“RNY”). Aurora holds over 80% of the units in RNY.

On 3 September 2018, RNY announced that Aurora, as investment manager of RNY, had successfully completed a loan modification deed with RNY’s lender, ACORE Capital. The loan modification resulted in, amongst other things, the curing of the existing loan default over the five remaining commercial property assets and the waiving USD$4.4 million in accrued default interest. In order to comply with the value accretive outcomes negotiated through the loan modification, RNY was required to make a series of loan paydowns to satisfy certain obligations. These paydowns were made from RNY’s and its associated entities existing cash reserves, and by short-term loans provided by AUP to RNY and its associated entities. These paydowns came into effect on 31 August 2018 (Melbourne time), in conjunction with the closing of the loan modification deed.

In light of these short-term loans provided by AUP, Aurora believes the Fund does not currently satisfy all the requisite conditions set by the ASX in relation to the waivers granted to the Fund (these conditions are set out in AUP’s most recent Product Disclosure Statement (“PDS”)). Specifically, the Fund does not currently meet the condition that requires it to invest solely in quoted fungible financial products and cash, therefore it is unable to rely upon these ASX waivers at this time, and cannot process off-market unit redemptions until further notice. The effect of this on redemptions which have been requested but not processed is discussed below.

It is Aurora’s intention as soon as practical to restore the investments of the Fund to those which satisfy the ASX conditions, therefore enabling the Fund to resume its reliance on these ASX waivers to process off-market redemptions.

On-market Buy-back

Aurora, as responsible entity of AUP, announces its intention to commence an on-market buy-back for up to 10% of AUP’s issued units, thereby providing unitholders with an additional ability to exit the Fund.

Current outstanding redemptions

Aurora will process and redeem all redemptions received and accepted by it prior to 31 August 2018 as soon as practicable in accordance with its Constitution. Aurora will also allow those unitholders who have submitted their redemption request on or after 31 August 2018 to cancel these requests if they so wish.

If you have any queries about the matters raised in this letter, please call me on 0411 886 626 or adrian@aurorafunds.com.au.

Dated 01/06/18 – Distribution Policy Update

Aurora Funds Management Limited (AFSL 222110) (“Aurora”) as responsible entity for the Aurora Property Buy-Write Income Trust (“AUP”), provides the following update in relation to AUP’s Distribution Policy.

AUP currently pays a quarterly distribution to unitholders of 2% of Net Asset Value (NAV), or, 8% per annum. Effective 30 June 2018, the quarterly distribution rate for the Fund will be adjusted to the greater of 1% of NAV (4% per annum) or distributable taxable income.

- Dated 22/3/18 – Temporary Amendment to Investment Strategy

Aurora Funds Management Limited (AFSL 222110) (“Aurora”) as responsible entity for the Aurora Property Buy-Write Income Trust (“AUP”) provides the following update in relation to the investment strategy of AUP.

AUP is the largest unitholder in RNY Property Trust (“RNY”), with Aurora and its funds collectively holding 80.96% of the total issued units. On 19 January 2018, Aurora called a unitholder meeting to consider two (2) resolutions, being (i) the removal of RNY’s current responsible entity (RE), RNY Australia Management Limited (RAML), and (ii) the appointment of Huntley Management Limited (“Huntley”) as RE.

The unitholder meeting was held 12 February 2018, and both resolutions were approved with 99.9% of unitholder votes in favour of the resolutions. The change of RE will not however be complete until Huntley receives approval for a variation of its Australian Financial Services Licence from the Australian Securities and Investments Commission (ASIC), which is currently under consideration.

In November 2017, ASIC’s service charter as set out in Report 553 was issued, which detailed changes to target timeframes for processing licence applications, being:

(a) within 150 days of receiving a complete application in at least 70% of cases (previously 60 days and at best 35 days); and

(b) within 240 days of receiving a complete application in at least 90% of cases (previously 120 days).

Unfortunately, the timeline for this approval is completely out of Aurora’s hands, and as such Aurora needs to take steps to ensure unitholder value is preserved in the interim.

Accordingly, Aurora gives 30 days’ notice to unitholders of a temporary modification in AUP’s investment strategy, to allow investments in unlisted international property related equity and debt instruments, specifically in relation to RNY’s existing North American assets.

It is Aurora’s intention to revert the investment strategy back to its current mandate as soon as practical after any RNY restructure is complete.

- Dated 29/11/17 – Payment of Offer Consideration RNY update

Aurora had previously understood that the cheques in payment of the Offer consideration amounts were posted on 21 November 2017. However, it appears from RAML’s announcement, and from information obtained independently by Aurora, that this may not have been the case as many accepting Unit Holders are yet to receive their payments.

Aurora confirms that, despite the unauthorised withdrawal of funds from AUP’s bank account and the confusion concerning the despatch of cheques for payment of the Offer consideration, AUP has the necessary funds to meet its obligations in respect of the Offer.

Aurora will cancel all the unpresented cheques and will re-issue those cheques. Aurora will make a separate announcement confirming dispatch of the re-issued cheques. Aurora apologises for any inconvenience caused.

Read more here.

- Dated 26/04/17 – Appointment of Chief Operating Officer

Aurora Funds Management Limited is pleased to announce it has expanded its management team with the appointment of Mr Ben Norman to the role of Chief Operating Officer, effective 26 April 2017.

Ben is a qualified Chartered Accountant, with over 16 years of professional and industry experience. Prior to joining Aurora, Ben was a Director in Ernst & Young’s Transaction Advisory Services division, where he spent over 9 years working on numerous due diligence, performance improvement, restructuring, turnaround, financial modelling and transaction integration engagements with clients in all industry sectors. While working with Ernst & Young, Ben also performed extended secondments with global financier GE Capital in a senior risk and compliance role and with ASX listed Origin Energy Limited as a finance manager in Origin’s upstream business.

Prior to joining Ernst & Young, Ben held a senior finance position with gas transmission business Epic Energy (which was owned by the ASX listed Hastings Diversified Utilities Fund, backed by Westpac Banking Corporation) where he was responsible for overall financial control and compliance.

Managing Director, John Patton, commented, “we are delighted to have secured the services of a very senior and experienced industry professional to Aurora’s management team. Ben Norman’s extensive professional and industry experience will be a valuable addition to Aurora’s capabilities”.

Operational Update

In light of the changes that have taken place within the business, Aurora has decided to update and refresh its Product Disclosure Statement (PDS). Pending this review being finalized, Aurora has withdrawn its PDS for new retail applications, however all existing terms will continue to apply save as varied in accordance with the terms of the PDS. Upon the lodgment of an updated PDS, the fund will then accept applications from new retail investors.

- Dated 07/12/16 – Voting Results of the Unitholder Meeting

In accordance with Listing Rule 3.13.2 and section 251AA of the Corporations Act 2001 (Cth), we advise that details of the resolutions and proxies received in respect of each resolution put to the General Meeting of the Aurora Property Buy-Write Income Trust, are set out in the attached proxy summary.

Resolution 1 – Removal of Responsible Entity was not carried.

Resolution 2 – Appointment of New Responsible Entity was not carried.

Aurora welcomes the outcome of the meeting, and now that this distraction is behind us, our capable and experienced team look forward to implementing the investment objectives of AUP for the benefit of all unitholders. Accordingly, Aurora will continue to act as the responsible entity of AUP and seek to accomplish the investment objectives and strategy of AUP.

- Dated 27/10/16 – Investments

Aurora Funds Management Limited (AFML) in conjunction with the Aurora Fortitude Absolute Return Fund (AFARF) has become an investor in the Aurora Property Buy-Write Income Trust (ASX: AUP).

The rationale for these investments is as follows:

- AFML has invested a portion of its funds in AUP in support of the investment activities undertaken by AUP, further aligning the manager with the performance of the Fund;

- AFARF has a relatively high level of cash on hand at present, enabling redemption requests to be processed quickly and efficiently. As such, the investment by AFARF in the AUP enables a portion of these funds to be actively managed on an ‘at call’ basis;

- AFML will rebate all management fees charged in AUP to AFARF to ensure no increased management expense to investors; and

- With an expanded investment pool within AUP, it follows that this should lead to a lower Management Expense Ratio for this Fund.

- Dated 08/07/2016 – Operating Expenses

Effective 8 August 2016, Aurora Funds Management Limited may begin charging all of its normal operating expenses to the Trust in accordance with the Constitution.

- Dated 18/9/2015 – Annual Reporting and Fund Disclosure as at 30th June 2015 for the Master Fund.

Asset Allocation: 99% invested in equities & 1% invested in cash.

Liquidity Profile: 88% within 10 business days and 12% within three months.

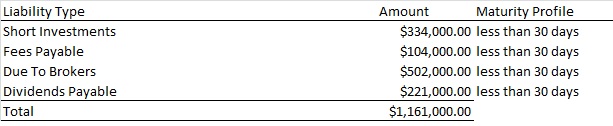

Maturity profile of the Fund’s liabilities:

Leverage: No leverage

Derivative Counterparties: UBS AG.

Investment Returns: +8.65% for the 2014/15 financial year.

Key Service Providers: Changed Primer Broker from JP Morgan to UBS.

- Dated 1/9/2015 – New Product Disclosure Statement (PDS) issued

Aurora is pleased to announce a new Product Disclosure Statement (PDS) has been issued. The PDS replaces the product disclosure statement dated 26 February 2009. The new PDS reflects:

-

- A reduction of management fees to 1.03% per annum (including GST);

- An increase in the performance fee hurdle to the RBA Cash Rate plus 1%; and

- The introduction of off market daily applications and redemptions.

- Dated 1/6/2015 – Reduction in Management Fee

From 1 July 2015 the Management Fee of the Aurora Property Buy-Write Income Trust will be reduced from 2.05% per annum (including GST) to 1.33% per annum (including GST). The current expense recovery of 0.1538% (including GST) will also be removed from 1 July 2015.

- Dated 2/7/2012 – GST Update

On 29 May 2012, amendments to the GST financial services regulations were released, including wide ranging new regulations relating to the reduced input tax credit treatment of supplies acquired by managed investment schemes and superannuation funds. The new rules apply from 1 July 2012.

The amendment regulations introduce a new item 32 of GST regulation 70-5.02(2) under which supplies acquired by a ‘recognised trust scheme’ on or after 1 July 2012 will be eligible for a 55% reduced input tax credit (RITC). Certain specified services will remain eligible for the 75% RITC.