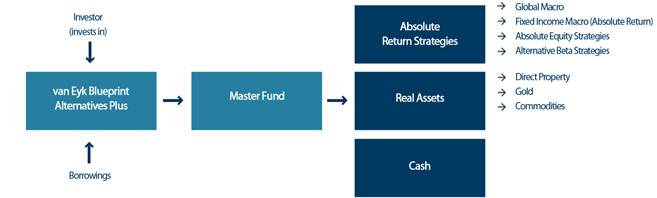

The Trust will invest directly into the van Eyk Blueprint Alternatives Fund (ARSN 112 183 249, the ‘Master Fund’ which is issued by Macquarie Investment Management Limited). Hence the investment range (net of gearing) of the Trust is:

| Investment | Exposure |

| Units in the Master Fund | 95% – 100% |

| Cash | 0% – 5% |

The above targets are indicative only. Where allocations are outside these targets, the intention is to re-balance the Trust within a reasonable period after the limits are exceeded.

The Master Fund provides an actively managed exposure to a diversified range of specialist investment managers (Underlying Managers) which are highly regarded by van Eyk, and strategies that invest in alternative assets such as absolute return strategies, alternative beta strategies, global macro, fixed income macro (absolute return), direct property, commodities and gold. The Master Fund may also invest directly in listed managed investments and derivatives.

Accordingly, the structure of the investment is summarised in the following diagram:

The actual allocations to each sub-sector and Underlying Manager selected is actively managed by van Eyk on an ongoing and regular basis and both will vary over time. For example, the Investment Manager may choose to add new or remove existing Underlying Managers from the portfolio.

Subject to van Eyk’s views as to the market and investment outlook, the Trust may use borrowings to increase its exposure to the investment strategy. The level of borrowings is expected to vary over time. Nevertheless, the Trust’s gearing is expected to be at (or below) 35% of net Assets (that is $1 of debt for every $2.85 in equity) on an ongoing basis. Should gearing ever temporarily exceed this level (for example, due to market movements or redemptions) the Trust will reduce gearing in an orderly manner. Borrowing magnifies returns (both positive and negative) relative to the returns of a comparable ungeared investment.