- Dated 07/08/23 – Board Changes

Aurora Funds Management Limited (Aurora) is pleased to announce that Mr Jeremy Kriewaldt has been appointed as a Non Executive Director of the Company.

Mr Kriewaldt is a lawyer in private practice, specialising in corporate and commercial law, including mergers and acquisitions, capital raisings and foreign investment, financial product development and securities markets. He started his own practice in 2018 and was previously a partner of Atanaskovic Hartnell (2004 – 2018), Blake Dawson Waldron (now Ashurst) (1990-2003) and served as Counsel to the Takeovers Panel in 2003-2004.

Mr Victor Siciliano who joined the Aurora Board in January 2018 has resigned as a Director of the Company. The Board would like to thank Mr Siciliano for his contribution to the Board during his tenure and wish him all the very best in his future endeavours.

- Dated 23/02/23 – Fund Update

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the Aurora Absolute Return Fund (ABW), Aurora Dividend Income Trust (ADIT), Aurora Fortitude Absolute Return Fund (AFARF), Aurora Global Income Trust (AIB), Aurora Property Buy-Write Income Trust (AUP) and HHY Fund (HHY) (collectively the Funds) provides the following market update, where applicable, in relation to the Funds’ investments in RNY Property Trust (RNY) and Molopo Energy Limited (Molopo).

RNY Property Trust update

RNY Property Trust (RNY) is an Australian unlisted property trust with five (5) commercial property assets located in the tri-state area of New York, USA, with 3 properties located in Long Island and 2 properties located in Westchester County, collectively having 830,000 sq feet of lettable office space. Huntley Management Limited is the responsible entity for RNY and Aurora Funds Management Limited is the investment manager.

On 6 October 2020, during COVID-19 (which greatly impacted New York city), Aurora closed a Loan Modification with RNY’s US lender, ACORE Capital (Lender) with a larger facility to fund certain planned capital works (as required by the Lender), with the following key terms:

-

- a three-year term – comprising an initial 6-month term, one six-month extension and two 12-month extension terms following the initial term;

- interest only;

- an existing loan facility of US$76.2 million, with US$64.6 million having been drawn, leaving US$11.6 million available for approved capital expenditures and leasing costs;

- a new mezzanine loan facility of US$15.6 million to fund additional approved leasing costs and capital expenditures; and

- RNY to complete the approved capital expenditure program.

Through the course of 2022, the Lender made various overreaching demands of RNY, including multimillion dollar claims for fees, which Aurora disputes, and demands that all the buildings be sold in an accelerated manner, for total sale consideration that would have amounted to circa US$92 million.

Separately, Aurora worked with an alternate financier (being a Tier 1 financier) to refinance the 3 Long Island properties (representing approximately two thirds of the portfolio’s lettable area), based on a signed Term Sheet for US$60 million of debt finance (before reserves) on those properties at prime lending rates (locked for 10 years in March 2022). The valuations obtained for the three Long Island properties, in an orderly market, to support this alternative financing exceeded US$90 million.

In addition, based on comparable recent sales of properties in the Westchester area, the value of the remaining 2 RNY properties (in Westchester) is in the vicinity of US$30 million, with these buildings having benefited from circa US$7 million of recent capital improvements.

In late 2022, the Lender took steps to enforce its security by seeking to commence foreclosure action, seeking to appoint a receiver, and selling the mezzanine debt in the US properties through a Uniform Commercial Code (UCC) auction process. This UCC process has the result of transferring the equity in the properties to purchaser of the mezzanine finance (which in this case totalled just US$1.7 million). The UCC auction process was ultimately cancelled after RNY’s related entity, RAOC, acquired the mezzanine debt and paid the associated fees (circa US$1 million).

Aurora is actively defending any enforcement actions taken by the Lender, and engaged US Counsel in June 2022 to assist. In addition, Aurora is working to resolve the deadlock situation with the Lender. Until this matter is satisfactorily resolved, and a new debt facility can be agreed, there is significant uncertainty regarding the valuation of the subordinated loans and equity interests in RNY.

RNY Leasing

Following the substantial capital works program, Aurora is encouraged by the current levels of improved leasing velocity. Aurora is however cautious given the current turbulent economic conditions and interest rate environment; and remains optimistic with the short to medium term prospects of the Portfolio. Furthermore, Aurora is pleased with the retention of its current tenants, with minimal reduction in the portfolio occupancy since the on-set of COVID.

Some recent new leasing highlights include:

-

- Full floor tenant (22,128 sq ft) signed with high-credit tenant on commercial terms at Westchester County property.

- Letter of intent with second full floor tenant (circa 22,000 sq ft) at Westchester County property. Similarly high credit tenant on commercial terms. This lease is expected to be finalised in the short-term.

- Letter of intent with third full floor tenant (circa 23,000 sq ft) at neighbouring Westchester County property. Similarly high credit tenant on commercial terms. This lease is expected to be finalised in the short-term.

- Letter of intent with tenant (circa 10,000 sq ft) at Westchester Country property. Similarly high credit tenant on commercial terms. This lease is expected to be finalised in the short-term.

Aurora is diligently working to convert the above-mentioned leases into executed deals. If completed, these prospective leases should materially enhance the occupancy and financial characteristics of the Portfolio.

Molopo Energy update

On 17 December 2021, Molopo Energy Limited (Molopo) advised (on its website) that it had settled the legal action against the former Molopo directors for A$12 million. This equates to 4.8 cents per Molopo share (based on 249,040,648 shares on issue).

Aurora notes that the value of the Funds (AFARF/ABW and AIB) investment in Molopo was written down to nil during the year ended 30 June 2021. The Funds have not adjusted the carrying value of its investment as it is waiting on the outcome of other litigation matters that Molopo is involved in.

The Funds continue to adopt a carrying value of $nil per Molopo share. Aurora will re-assess the carrying value of its investment in Molopo based on further information being released by Molopo regarding its financial position.

Redemptions

Given the uncertainty created by the abovementioned matters, where applicable, Aurora considerers it prudent to maintain a temporary hold on Redemptions until the outcome of the above two (2) matters is known.

Yours faithfully

Aurora Funds Management Limited

John Patton

- Dated 20/12/21 – Valuation of Molopo Energy Limited – Update

On 17 December 2021, Molopo Energy Limited (Molopo) advised (on its website) that it had settled the legal action against the former Molopo directors for A$12 million. This equates to 4.8 cents per Molopo share (based on 249,040,648 shares on issue).

Aurora proposes to adjust the carrying value of the Fund’s investment in Molopo when it is made aware of (a) Molopo’s total cash position, (b) the other litigation matters involving the Company and (c) the Drawbridge investment, which is likely to be when the Company releases its financial statements for the year ended 31 December 2021.

Aurora will continue to monitor this situation and will provide further updates as required.

- Dated 01/03/21 – Valuation of Molopo Energy Limited – Update

AIB holds an investment in the ordinary shares of Molopo Energy Limited (ASX: MPO), which was suspended from trading on the Australian Stock Exchange on 27 July 2017 and remains suspended as at the date of this update.

On 1 February 2019, Aurora announced that the fair value of the holding in Molopo had been reduced from 2.6 cents per share to 1.9 cents per share, based on material information which had come to light between 27 September 2018 and 1 February 2019. On 2 September 2019, Aurora announced that the fair value of the holding in Molopo had been further reduced to 1.5 cents. On 30 October 2019, Aurora announced that the fair value had been further reduced to 0.9 cents. On 6 February 2020, Aurora announced that the fair value had been further reduced to 0.5 cents. On 31 August 2020, Aurora announced that the fair value had been further reduced to 0.4 cents.

On 25 February 2021, Molopo released its Quarterly Cash Flow Statement for the quarter ended 31 December 2020. Based on the information contained in this Quarterly Cash Flow Statement, Aurora has reassessed the carrying value of its investment in Molopo and has decided to write the value of its investment down from 0.4 cents to nil. The rationale for this decision is summarised below:

- Today, Molopo’s primary assets comprise its cash reserves and its investment in Drawbridge. Molopo has advised that the cash reserves at 31 December 2020 amounted to A$8.368 million. Based on the structure of the Drawbridge investment, whereby Molopo has a 30% holding in a foreign private company with no voting rights and only a limited ability to appoint a director, it is difficult to ascribe any value to this investment – based on the information that has been released to date by Molopo. As such, for the purpose of valuing its investment in Molopo, Aurora continues to place nil value on the Drawbridge investment. Aurora notes that this treatment is consistent with the approach adopted by the current directors of Molopo. The Directors’ Report contained in Molopo’s Financial Report for the half year ended 30 June 2020 states:

“The Current Directors of Molopo … continue to undertake detailed investigations into the Orient Transactions and the Drawbridge Transactions which were entered into by former Directors of Molopo without seeking shareholder approval. The Current Directors maintain these actions were in breach of Directors duties, the ASX Listing Rules, ASX continuous disclosure obligations and provisions of the Corporations Act. This position has been supported by subsequent findings of the Takeovers Panel.

In brief, the combined Orient Transactions and Drawbridge Transactions involved in aggregate a US$35 Million investment by Molopo in Orient FRC Limited, a British Virgin Islands entity which, as a wholly-owned subsidiary of Molopo, Orient ultimately acquired a 30% non-voting A class share interest in Drawbridge.

Sopris Energy Investments Ltd., another British Virgin Islands entity and the majority 70% shareholder of Drawbridge, holds 100% of the voting rights in Drawbridge which it appears to have acquired without contributing any cash or other assets to the transaction.”

Further, the Directors’ Report contained in Molopo’s Financial Report for the half year ended 30 June 2019 states:

“In the year ended 31 December 2018, the Current Directors resolved that they could not identify evidence to support a value for the oil & gas exploration and production assets held by Drawbridge and accordingly Molopo’s investment through Orient was impaired to Nil, as reported in the 31 December 2018 Annual Report.

Although the Current Directors have impaired the investment in full, they continue to vigorously pursue legal proceedings against the Former Directors of the Company responsible for entering into these transactions to hold them accountable for breach of directors’ duties with the objective of recovering as much value as possible for Molopo shareholders.

The Current Directors remain firmly of the view that the litigation proceedings against the Former Directors provides the best opportunity for Molopo shareholders to recover any value from the actions undertaken by Former Directors entering into the Orient Transactions and Drawbridge Transactions.”

- In the June 2020 Quarterly Activities Statement, released on 31 July 2020, Molopo advised that:

“Drawbridge Operations

Molopo has received Financial Statements and an Operations Report for 4Qtr-2019 which Drawbridge was required to provide within 60 days of the end of that quarter as ordered by the Court. Molopo has also received Financial Statements and an Operations Report for 1Qtr-2020. The Directors are unable to rely on these Financial Statements and Operations Reports with any confidence as they provide no financial detail and do not disclose any significant update on project operations.

Legal Actions

Drawbridge – the Company’s legal action in the USA against the Drawbridge group was amended to a reduced claim for breach of the Contribution Agreement with the remaining claims discontinued without prejudice, after the Drawbridge parties filed for Summary Judgment in the proceedings. The remaining claim by Orient against Drawbridge for breach of the Contribution Agreement has been set down for hearing on 5 August 2020

Former Directors – … the Company continues to vigorously pursue its claims in the Supreme Court of Victoria against the Former Directors of the Company (which now includes the Estate of the Late Samuel Belzberg) and remains confident that this will result in a successful recovery against the Former Directors”

- In the financial statements for the half-year ended 30 June 2020, Molopo continued to recognise a contingent liability in relation to a long-standing legal action in Canada concerning the Company and Molopo Energy Canada Ltd (“MECL”), a wholly owned subsidiary of the Company. In the annual audited financial statements for the year ended 31 December 2018, which were released by Molopo on 7 May 2019, the long-standing provision of C$8.4 million was removed, with the following commentary being provided:

“In March 2011, MECL was served with a statement of claim by a former joint venture partner (3105682 Nova Scotia ULC) “310 ULC”) claiming MECL breached various agreements relating to the relevant joint venture, including breach of fiduciary duties, trust and good faith. 310 ULC has sought declarations, accountings, damages of 25% revenue, C$35.0 (A$35.9) million general damages, C$1.0 (A$1.0) million punitive and aggravated damages, interest, GST and indemnity costs.

Subsequent to the filing of the statement of defence, the Company undertook an extensive examination of the transactions that gave rise to the amounts in dispute. This examination resulted in the Company applying a provision in the accounts in 2012 of a net C$5.0 (A$5.1) million. In early 2013, the JV Partner settled a counterclaim by making a payment of C$3.4 (A$3.5) million to the Company, at which time the Company increased the provision to C$8.4 (A$8.6) million.

During the current reporting period the Directors have reconsidered the circumstances that gave rise to recognition of the provision. A significant amount of time has passed since the provision was brought to account with limited progress on the claim. The Directors have reviewed the current status of the claims as provided by its lawyers and based upon this status update, the time elapsed and the limited progress made in the proceedings, they have taken the view that the amount of the provision can no longer be reliably measured, and therefore no longer meets the recognition criteria for a liability. Based on these findings, the Directors have reversed the provision and fully disclosed the claims as a contingent liability.”

This is consistent with the disclosures made in the financial statements for the financial year ended 31 December 2019.

- Molopo currently has 249,040,648 ordinary shares on issue;

- Based on the above, Aurora considers the appropriate carrying value of its investment in Molopo to be nil, calculated as follows:

- cash reserves of $8.368 million; less

- litigation provision of A$8.571 million, being the Australian dollar equivalent of $8.4 million Canadian dollars as at 31 December 2020. In the Molopo financial statements for the year ended 31 December 2018 this provision was removed as a liability in the balance sheet and disclosed as a contingent liability. It is still disclosed as a contingent liability in Molopo’s financial statements for the half year ended 3 June 2020. For the purpose of this valuation, Aurora has no reason to believe that this is not a reasonable estimate of the expected liability;

- divided by 249,040,648 ordinary shares on issue; which

- equates to a negative value per share.

- As more information is released by Molopo on the Drawbridge investment, including the outcome of the claim against the Former Directors, along with the Canadian litigation, it may be appropriate for Aurora to revisit the carrying value of its Molopo investment.

The fair value of the Molopo Investment is based on significant estimates and judgements adopted by the Board of Aurora based on all available information about Molopo as at the current date.

The Aurora Board considered the range of possible values and determined that the fair value of the Molopo investment held by the Fund should now be valued at nil.

Aurora continues to pursue avenues to recover value that has been lost by the former directors of Molopo.

This announcement was authorised for release by Aurora’s Managing Director.

- Dated 30/09/20 – RNY Property Trust revaluation

Aurora Funds Management Limited (Aurora), in its capacity as the responsible entity of the Aurora Property BuyWrite Income Trust, Aurora Fortitude Absolute Return Fund, Aurora Global Income Trust and the Aurora DividendIncome Trust (Fund(s)), provides the following update in relation to the RNY Property Trust (RNY).

RNY has been suspended from trading on the Australian Securities Exchange (ASX) since 1 April 2019, due to delays experienced in finalising its audited financial statements for the year ended 31 December 2018 and half year ended 30 June 2019, followed by the Audit Disclaimer Opinion issued in relation to the year ended 31 December 2019. Aurora understands that RNY is due to release its Audit Reviewed financial statements for the half year ended 30 June 2020. In the event a clear audit review statement is issued, Aurora understands that RNY will then be in a position to apply for recommencement of trading on the ASX.

On 23 September 2019, RNY announced it had completed an independent valuation of its 5 commercial office properties in the New York tri-state area, resulting in a 16% uplift on previous valuations and a material uplift in RNY’s Net Tangible Asset (NTA) backing. Given RNY’s suspension from trading on the ASX, there was no actively traded market available for Aurora to determine the market value for RNY’s securities. As such, the independent valuation obtained by RNY was considered the most appropriate basis on which to determine the carrying value of RNY, with Aurora’s direct investments being carried at a small discount to RNY’s improved NTA.

On 29 June 2020, Keybridge Capital Limited (Keybridge) announced its intention to make an off-market all scrip takeover bid for RNY at an implied offer price of $0.011 per RNY unit1 (Keybridge Offer), with its Bidder’s Statement being dispatched on 28 August 2020. On 28 September 2020, Keybridge issued a substantial holder notice stating it had acquired a relevant interest of 1.01% in RNY (from parties other than Aurora) through acceptances into the Keybridge Offer. Aurora has also elected to accept a portion of its Funds holdings into the Keybridge Offer. Consistent with its previous “truth in takeovers” statement, Aurora has limited its acceptances into the Keybridge Offer at 41,450,000 RNY units.

As a consequence of the acceptances into the Keybridge Offer, the implied offer price of $0.011 per RNY unit is now the most readily observable price for RNY securities. As such, this has resulted in the carrying value of Aurora’s direct investments in RNY being reduced from $0.044 to $0.011 per RNY unit, across its various Funds.

Following the recommencement of trading in RNY securities on the ASX, Aurora will continue to adjust its direct investment in RNY to reflect the last traded market price.

This announcement was authorised for release by Aurora’s Managing Director.

- Dated 31/08/20 – Valuation of Molopo Energy Limited – Update

Aurora Funds Management Limited (“Aurora”) provides the following valuation update in respect of the Aurora Global Income Trust (“AIB”).

On 31 July 2020, Molopo released its Quarterly Cash Flow Statement for the quarter ended 30 June 2020. Based on the information contained in this Quarterly Cash Flow Statement, Aurora has reassessed the carrying value of its investment in Molopo and has decided to write the value of its investment down from 0.5 cents 0.4 cents. The rationale for this decision is summarised here:

- Dated 18/08/20 – Resignation of Joint Company Secretary and Change in Compliance Committee

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the HHY Fund (HHY), the Aurora Property Buy-Write Income Trust (AUP), the Aurora Global Income Trust (AIB) and the Aurora Absolute Return Fund (ABW), provides the following update as a result of ASX enquiries:

Mr Briglia’s role as Chief Financial Officer and Joint Company Secretary ceased on 1 April 2020 which coincided with the COVID-19 national lockdown measures introduced by the Australian Federal Government in March 2020. Mr Briglia’s financial responsibilities have been absorbed by Aurora’s existing finance, compliance and operations team, and Mr Patton has assumed sole responsibility for the Company Secretarial function (having been appointed as a Company Secretary on 29 November 2017).

Mr Patton also replaced Mr Briglia as the internal member of Aurora’s Compliance Committee, with the other two independent members being Mr Anthony Hartnell AM and Mr Patrick

Burroughs.

This announcement was authorised for release by Aurora’s Managing Director.

- Dated 29/06/20 – ADIT Bid Update

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the Aurora Dividend Income Trust (ADIT), the HHY Fund (HHY) and the Aurora Fortitude Absolute Return Fund (AFARF), provides the following update in relation to the ADIT takeover bid for the ordinary shares in Keybridge Capital Limited (Keybridge) which closed on Monday, 6 April 2020.

Read more here.

- Dated 06/02/20 – Valuation of Molopo Energy Limited – Update

Aurora Funds Management Limited (“Aurora”) provides the following valuation update in respect of the Aurora Global Income Trust (“AIB”).

Valuation of Molopo Energy Limited shares

AIB holds an investment in the ordinary shares of Molopo Energy Limited (ASX: MPO), which was suspended from trading on the Australian Stock Exchange on 27 July 2017 and remains suspended as at the date of this update.

On 1 February 2019, Aurora announced that the fair value of the holding in Molopo had been reduced from 2.6 cents per share to 1.9 cents per share, based on material information which had come to light between 27 September 2018 and 1 February 2019. On 2 September 2019, Aurora announced that the fair value of the holding in Molopo had been further reduced to 1.5 cents. On 30 October 2019, Aurora announced that the fair value had been further reduced to 0.9 cents.

On 3 February 2020, Molopo released its Quarterly Cash Flow Statement for the quarter ended 31 December 2019. Based on the information contained in this Quarterly Cash Flow Statement, Aurora has reassessed the carrying value of its investment in Molopo and has decided to write the value of its investment down from 0.9 cents 0.5 cents. The rationale for this decision is summarised here.

- Dated 08/01/20 – Appointment of New Chief Financial Officer and Company Secretary

Aurora Funds Management Limited, as Responsible Entity the Aurora Global Income Trust announces that Mr Adrian Tilley has resigned as Chief Financial Officer and Company Secretary to take up a role in his family business in his regional hometown of South Gippsland, Victoria. The Board acknowledges the substantial contribution made by Mr Tilley during his tenure with Aurora and sincerely wishes him all the very best in his future endeavours.

Aurora is pleased to announce that Mr Mark Briglia has been appointed to the role of Chief Financial Officer and Company Secretary. Mr Briglia’s most recent role was as Chief Financial Officer and Group Manager, Australian Energy Market Operator. Mr Briglia has deep industry experience across a number of sectors at the executive level both in Australia and internationally. In addition, he is a Certified Practicing Accountant and holds a Master of Business Administration and a Bachelor of Commerce (University of Melbourne).

Mark will also replace Adrian Tilley as the internal member of Aurora’s Compliance Committee.

- Dated 30/10/19 – Valuation of Molopo Energy Limited – Update

-

Aurora Funds Management Limited (“Aurora”) provides the following valuation update in respect of the Aurora Global Income Trust (“AIB”).

Valuation of Molopo Energy Limited shares

AIB holds an investment in the ordinary shares of Molopo Energy Limited (ASX: MPO), which was suspended from trading on the Australian Stock Exchange on 27 July 2017 and remains suspended as at the date of this update.On 1 February 2019, Aurora announced that the fair value of the holding in Molopo had been reduced from 2.6 cents per share to 1.9 cents per share, based on material information which had come to light between 27 September 2018 and 1 February 2019. On 2 September 2019 Aurora announced that the fair value of the holding in Molopo had been further reduced to 1.5 cents.

On 30 October 2019, Molopo released its Quarterly Cash Flow Statement for the quarter ended 30 September 2019. Based on the information contained in this Quarterly Cash Flow Statement, Aurora has reassessed the carrying value of its investment in Molopo and has decided to write the value of its investment down from 1.5 cents to 0.9 cents.

Read more here.

- Dated 03/05/19 – Distribution Policy Update

Aurora Funds Management Limited (ACN 092 626 885) (“Aurora”), in its capacity as the responsible entity of the Aurora Global Income Trust (“AIB or “Fund”), provides the following update in relation to AIB’s Distribution Policy.

AIB currently pays quarterly distributions to unitholders, being the greater of 0.5% of its Net Asset Value (NAV) per quarter (2.0% per annum) or its distributable taxable income. Aurora hereby provides notice that it has elected to adjust the distribution policy for the Fund, such that the Fund will pay out its distributable taxable income on a semi-annual basis (in respect of the periods ended 30 June and 31 December each year) up to 1.0% of NAV per period (2.0% per annum). This change in distribution policy will take place following the 30 June 2019 quarterly distribution.

- Dated 01/03/19 – Fee and Expenses Update

Aurora Funds Management Limited (ACN 092 626 885) (“Aurora”), in its capacity as the responsible entity of the Aurora Global Income Trust (“AIB” or “Fund”), provides the following update in relation to AIB’s management fees, performance fees and other operating costs.

Waiving of Management Fees and Capped Normal Operating Expenses

The Fund currently pays 1.3325% per annum in management fees and 20.50% in performance fees (including GST) above its watermark. The Fund also meets the various normal operating expenses, including ASX listing fees, registry fees, accounting, audit and compliance fees, in accordance with its Constitution. These normal operating expenses, which are fixed in nature, have increased relative to the Fund’s net assets following the write-down of the Fund’s investment in Molopo Energy Limited.

From 1 March 2019, in response to the smaller net asset position of the Fund, Aurora has elected not to charge its management fees and will also cap normal operating expenses at no more than 2.00% (ex GST) of the Fund’s net assets (per annum). Normal operating costs incurred by the Fund above this cap will therefore be borne by Aurora in its own capacity until further notice. Aurora notes that any extraordinary costs will still remain an expense of the Fund.

Resetting Watermark and Performance Fee Change

Aurora hereby provides 30-day notice that it will be resetting the Fund’s performance fee hurdle in accordance with Fund’s Constitution, to the Net Asset Value (NAV) as at 30 June 2018 plus the accrued hurdle. This amounts to a benchmark of $0.258 per unit at the effective date (1 April 2019), a premium of 67% to the Fund’s current NAV of $0.155. Aurora is also increasing the performance fee from 20.5% to 25% (including GST).

In effect, this means that Aurora will cover the Fund’s excess operating costs over 2.00% (excluding GST) and waive its base management fee for the benefit of the Fund, and will only earn a fee when the value of the fund grows by in excess of 67%.

- Dated 14/08/18 – Valuation of Molopo Energy Limited & Off-market Redemptions Update

Aurora Funds Management Limited (“Aurora”) provides an update in respect to the Aurora Fortitude Absolute Return Fund (“AFARF”), which directly impacts the Aurora Global Income Trust Fund. Attached is a copy of the relevant announcement by AFARF.

In light of the announcement by AFARF, including the write down of its investment in Molopo Energy Limited to 3.6 cents as at 30 June 2018, all investors that had previously lodged Redemption Requests will now have the option of withdrawing their Requests until 31 August 2018.

Read more here.

- Dated 29/06/18 – Molopo Energy update and Fund Redemptions

Aurora Funds Management Limited (Aurora), in its capacity as responsible entity for the Aurora Global Income Trust Fund (Fund), provides unitholders with an update in relation to the Fund’s investment in Molopo Energy Limited (MPO).

Molopo Energy Limited’s unacceptable circumstances and breach of ASX Listing Rules

In response to an application made by Aurora to the Takeovers Panel (Panel), the Panel made a declaration of unacceptable circumstances1 against MPO following a series of transactions it announced on 8 May 20182. These transactions were determined to be frustrating actions in relation to AFARF’s takeover bid and Molopo’s Target Statements were deemed to contain omissions and misleading and deceptive information. This follows a finding by the ASX on 11 May 20183 that stated MPO had breached ASX Listing Rules and may have also breached various sections of the Corporations Act for making misleading disclosures to the ASX.

Impact on MPO value, Fund NAV and AFARF’s current takeover offer

Aurora has formed the view that if these transactions are not capable of being unwound, with the cash value returned to MPO, the value of this investment, which represents 55% of the Fund’s Net Asset Value (NAV), will need to be written down. It follows that any such write-down would have a material effect on the Fund’s NAV. Aurora will await the outcome of the Panel orders prior to determining whether to write down the value of its MPO investment and whether to exercise its right to withdraw AFARF’s current takeover offer.

Impact on Redemptions

Aurora considers it prudent to delay redemptions until such time that it receives final orders from the Panel and subsequently forms a considered view on the appropriate carrying value of the Fund’s investment in MPO.

- Dated 01/06/18 – Distribution Update

Aurora Funds Management Limited (ACN 092 626 885) (“Aurora”), in its capacity as the responsible entity of the Aurora Global Income Trust (“AIB”), provides the following update in relation to AIB’s Distribution Policy.

AIB currently pays a quarterly distribution to unitholders of 2% of Net Asset Value (NAV), or, 8% per annum. Effective 30 June 2018, the quarterly distribution rate for the Fund will be adjusted to the greater of 0.5% of NAV (2% per annum) or distributable taxable income.

- Dated 08/12/2017 – Investment Strategy Update

Aurora Funds Management Limited (ACN 092 626 885) (“Aurora”), in its capacity as the responsible entity of the Aurora Global Income Trust (“AIB” or “Fund”), provides the following update in relation to its earlier announcement made on 28 September 2016, via the fund update section on Aurora’s website, regarding and Enhancement to Investment Strategy.

On 28 September 2016, Aurora notified AIB unitholders of its intention to change the Funds investment strategy, specifically by changing the single position limit restrictions from “no long position can exceed 12% of the NAV on a cost basis” to “no long position can exceed 80% of the NAV on a cost basis”. Aurora previously advised that it would re-evaluate this change in investment strategy once the takeover for the HHY Fund had been completed. As such, Aurora hereby advises that previously announced change in investment strategy will remain in effect and form part of AIB’s ongoing investment strategy.

- Dated 26/04/17 – Appointment of Chief Operating Officer

Aurora Funds Management Limited is pleased to announce it has expanded its management team with the appointment of Mr Ben Norman to the role of Chief Operating Officer, effective 26 April 2017.

Ben is a qualified Chartered Accountant, with over 16 years of professional and industry experience. Prior to joining Aurora, Ben was a Director in Ernst & Young’s Transaction Advisory Services division, where he spent over 9 years working on numerous due diligence, performance improvement, restructuring, turnaround, financial modelling and transaction integration engagements with clients in all industry sectors. While working with Ernst & Young, Ben also performed extended secondments with global financier GE Capital in a senior risk and compliance role and with ASX listed Origin Energy Limited as a finance manager in Origin’s upstream business.

Prior to joining Ernst & Young, Ben held a senior finance position with gas transmission business Epic Energy (which was owned by the ASX listed Hastings Diversified Utilities Fund, backed by Westpac Banking Corporation) where he was responsible for overall financial control and compliance.

Managing Director, John Patton, commented, “we are delighted to have secured the services of a very senior and experienced industry professional to Aurora’s management team. Ben Norman’s extensive professional and industry experience will be a valuable addition to Aurora’s capabilities”.

Operational Update

In light of the changes that have taken place within the business, Aurora has decided to update and refresh its Product Disclosure Statement (PDS). Pending this review being finalized, Aurora has withdrawn its PDS for new retail applications, however all existing terms will continue to apply save as varied in accordance with the terms of the PDS. Upon the lodgment of an updated PDS, the fund will then accept applications from new retail investors.

- Dated 18/04/17 – Takeovers Panel – MPO

Further to the announcement made by Aurora Funds Management Limited (“Aurora”) on 12 April 2017 in relation to applications made by the Australian Securities and Investments Commission (“ASIC”) and Molopo Energy Limited (“Molopo”) to the Takeovers Panel seeking declarations of unacceptable circumstances in relation to Aurora’s acquisitions of shares in Molopo on the basis of an alleged ‘association’ with Keybridge Capital Limited, Aurora notes that:

1. the members of the Panel who will consider the applications have been appointed;

2. the Panel has not yet decided whether to conduct proceedings on either application; and

3. if proceedings are conducted, one of the orders sought by ASIC is that approximately 39.5 million Molopo shares held by Aurora be sold within a period of 3 months (with the net proceeds of sale being paid to Aurora). If such an order were to be made, the effect that the sale of such a large number of shares in a relatively short timeframe would have on the trading price of Molopo shares is unknown (and could be adverse, having regard to the illiquid nature of trading in Molopo shares).

Aurora also notes that in the separate application made by Molopo, a divestment order is also sought on the basis that Aurora not receive any profit on the sale of the shares.

The Molopo shares owned by Aurora on behalf of Aurora Fortitude Absolute Return Fund and Aurora Global Income Trust currently represent approximately 30.4% and 39.5% respectively of the value of the assets of those funds.

As stated in its announcement on 12 April 2017, Aurora intends to vigorously oppose the applications.

- Dated 08/02/17 – Update in relation to the Investment Strategy

Aurora Funds Management Limited (“Aurora”) provides the following update in relation to the investment strategy for the Aurora Global Income Trust.

-

- Historically, Aurora has typically targeted a large number of positions in highly liquid investments. Whilst this still forms the basis of the investment strategy, Aurora is also prepared to take more concentrated and/or substantial positions where there is an opportunity to take an active role in creating a catalyst to unlock underlying value. Aurora believes the pursuit of these opportunities will enable the Trust to generate higher investment returns over the longer term whilst potentially increasing volatility.

- The current Product Disclosure Statement (“PDS”) contemplates 90% of the Trust’s assets being able to be liquidated within 10 business days. The Trust will revert to the liquidity requirements contained in its Constitution, which is consistent with the Corporations Act.

- All investments continue to be managed within the Investment Mandate as outlined in the current Product Disclosure Statement’s and Trust Updates.

- Dated 06/12/2016 – Voting Results of the Unitholder Meeting

In accordance with Listing Rule 3.13.2 and section 251AA of the Corporations Act 2001 (Cth), we advise that details of the resolutions and proxies received in respect of each resolution put to the General Meeting of the Aurora Global Income Trust, are set out in the attached proxy summary.

Resolution 1 – Removal of Responsible Entity was not carried.

Resolution 2 – Appointment of New Responsible Entity was not carried.

Aurora welcomes the outcome of the meeting, and now that this distraction is behind us, our capable and experienced team look forward to implementing the investment objectives of AIB for the benefit of all unitholders. Accordingly, Aurora will continue to act as the responsible entity of AIB and seek to accomplish the investment objectives and strategy of AIB.

- Dated 06/10/2016 – Amendment to reflect provisions in the AIB Constitution

Effective 7 November 2016, Aurora Funds Management Limited gives notice that the liquidity requirements of Aurora Global Income Trust (AIB) will be amended to reflect the provisions in the AIB Constitution, which is consistent with the Corporations Act.

- Dated 28/09/2016 – Enhancement to Investment Strategy

Effective 28 October 2016, Aurora is pleased to notify Aurora Global Income Trust (AIB) investors of our intention to enhance the investment opportunities of the Trust by amending the following limitation under its investment strategy, being “no long position can exceed 12% of the NAV on a cost basis” to “no long position can exceed 80% of the NAV on a cost basis”. Aurora considers that this amendment is appropriate to facilitate the takeover of HHY Fund and will be re-evaluated once the takeover is completed. Aurora does not consider that this will significantly alter the risk profile of the Fund, and will provide an updated Product Disclosure Statement in due course with further background.

- Dated 31/08/2016 – Resumption of Off-market Redemptions

Aurora Funds Management Limited (“Aurora”) provides the following update in respect of the Aurora Global Income Trust (“the Trust”).

Antares Convertible Note Update.

As at 30 June 2016, the Trust held investments in Antares Energy Limited Convertible Notes (ASX: AZZG), which had been suspended from trading on the Australian Stock Exchange on 15 September 2015 and remain suspended as at the date of this update.

In February 2016, Aurora made the decision to freeze applications and redemptions in the Trust, on the basis that it could not accurately determine a value for the AZZG Notes.

For the purposes of the June 2016 year-end financial statements, and after careful consideration of all of the available information, Aurora has formed the view that the AZZG Notes should be recognised at a nil value. In forming this view, Aurora has relied on the following information:

On 8 April 2016, Antares Energy Limited (“Antares”) issued a notice of resumed meeting of noteholders (to be held on 29 April 2016) to, amongst other things, extend the reset date of the AZZG Notes to 31 March 2017 and amend the next interest payment date to 30 April 2017. This meeting did not proceed.

On 29 April 2016, Antares appointed Bryan Kevin Hughes and Daniel Johannes Bredenkamp of Pitcher Partners as Joint and Several Administrators.

On 10 May 2016, following a resolution passed at the first meeting of creditors, Quentin James Olde and Michael Joseph Ryan of FTI Consulting replaced Bryan Kevin Hughes and Daniel Johannes Bredenkamp of Pitcher Partners as Joint and Several Administrators of Antares.

As part of the 30 June 2016 year end audit procedures, Aurora engaged an external independent valuer in the US, South Texas Reservoir Alliance LLC (STXRA), to perform an independent valuation of the underlying assets of Antares, being Northern Star and Big Star (STXRA conducted a similar valuation for the purposes of Aurora’s 31 December 2015 financial statements). In summarising the STXRA valuation, the following observations are relevant:

o STXRA reviewed, in the course of its analysis, both recent market transactions and public land records to provide both a liquidation and transactional evaluation of the assets;

o The Administrator of Antares, FTI Consulting, made an ASX Announcement on 30 August 2016 calling for Expressions of Interest. In that Announcement, the Administrator advised that circa 5,000 acres of leased land had expired, leaving circa 15,900 acres;

o STXRA indicated that “there is a trend in the E&P industry right now to only focus on core acreage and this leasehold is not considered core in the Midland basin so the number of potential purchasers for this asset are pretty limited”;

o STXRA provided a valuation range of between USD$985,000 (representing 2X the lower end of the Liquidation value) to USD$12,312,500 (representing 5X the upper end of the Liquidation value) (being AUD$1,279,055 to AUD$15,988,183). The face value of the AZZG Notes is AUD$47.5 million;

o STXRA concluded that Antares, given its financial situation and inaction on its leases, would probably tend more towards lower end of liquidation pricing;

o STXRA also noted that “due to Antares lease position falling apart and the recent lower price per acre metrics, it appears that this asset will tend to the lower values”;

o The STXRA valuation range excludes any other liabilities and costs that need to be satisfied by the Administrator;

o The Trust holds circa 1.0% of the AZZG Notes, thereby bringing the valuation range (before other liabilities and Administration costs) to circa AUD$12.5K to AUD$156.7K;

o Antares has been trying to sell the asset for a number of years, with no sale forthcoming; and

o The external valuation is based on the value of the acreage, so any costs of administration would need to be paid first.

In addition to the STXRA valuation, Aurora management had regard to confidential information and reports provided by the Administrators.

The fair value of the AZZG Notes is based on significant estimates and judgements adopted by management of Aurora based on the prevailing market conditions and all available information about Antares as at the date of the 30 June 2016 financial report.

Aurora management considered the range of possible values and determined that the fair value of the AZZG Notes held by the Trust should be nil as at 30 June 2016.

As part of the year-end audit procedures, the external auditors (Deloitte) reviewed the analysis prepared by Aurora management along with the associated reports and concurred with the position taken.

Resumption of off-market Redemptions

In light of the above write down of the Antares AZZG Notes to nil as at 30 June 2016, the Trust is now unfrozen and as such is able to resume the processing of off-market redemptions, effective 31 August 2016.

Read more here.

- Dated 19/08/2016 – Update of investment in Antares Energy Limited Convertible Notes

Aurora Funds Management Limited (“Aurora”) as responsible entity of the Aurora Global Income Trust (the “Fund”), provides the following update to investors.

As part of the annual preparation for financial reporting, Aurora advises that it expects to recognise a non-cash impairment charge against the carrying value of the Antares Energy Limited Convertible Notes (ASX Code: AZZG) (“Antares Notes”) held by the Fund as at 30 June 2016.

The impairment charge reflects information that has become available through the audit process and which leads Aurora to believe there is a possibility that the value of the Antares Notes is substantially less than the current carrying value of $1.82 per note.

The exact amount of the impairment charge is subject to finalisation of the Fund’s full year audited financial statements, which will be released on or around 31 August 2016.

We will continue to monitor the situation and provide additional information on any material changes in due course through ASX announcements.

- Dated 08/07/2016 – Operating Expenses

Effective 8 August 2016, Aurora Funds Management Limited may begin charging all of its normal operating expenses to the Trust in accordance with the Constitution.

- Dated 01/04/2016 – Antares Energy Limited Convertible Notes meeting postponed

Aurora Funds Management Limited (“Aurora”) as Responsible Entity of the Aurora Global Income Trust (“the Fund”) refers to its voluntary suspension from trading and recent announcements in relation to its investment in Antares Energy Limited Convertible Notes (“the Notes”).

The Noteholders meeting was held on 31 March 2016, however, the vote did not proceed and the Noteholders meeting has been postponed until 29 April 2016.

Aurora advises that its voluntary suspension is expected to remain in place for an additional period of up to one month or until further information becomes available to us.

We will continue to monitor the situation and provide any additional information on any material changes in due course through ASX announcements.

- AIB – Letter to Unit Holders

Suspension of applications and redemptions and suspension from trading on ASX From 25th February 2016, applications, redemptions and dividend reinvestments for the Aurora Global Income Trust (Fund) are temporarily suspended. This means you will not be able to apply for or redeem your units in the Fund until further notice.

The Fund is also suspended from trading on the ASX.

Background

The Aurora Global Income Trust Fund holds Antares Energy Limited Convertible Notes (ASX Code: AZZG) (Antares Notes) which have been suspended from trading and are, consequently, currently illiquid. The note is due to be repaid on 31st March 2016, but information has become available to us which leads us to believe there is a possibility that repayment will not occur on this date, and therefore we are unable to accurately determine a value for the Antares Notes. This uncertainty means we do not believe it is the best interest of unit holders to continue to accept applications and

redemptions, and to allow on market trades whilst there is doubt about the liquidity of a position within the Fund’s portfolio. The Antares Notes currently comprise 9.58% of the net asset value of the Fund, but this percentage may change as the value of the Antares Notes, and the value of the Fund’s other assets change.Acting in the best interests of Investors

Aurora has determined that, in these circumstances, it is in the best interest of investors in AIB, as a whole to temporarily suspend applications and redemptions and halt market trading to ensure all investors are treated equally so there is fair treatment between investors who choose to remain invested in the Fund and investors who choose to exit the Fund in the short to medium term.

What this means for you

The Fund has ceased accepting any off market applications for units or processing off market redemption requests effective from 25th February 2016. Any application funds received will be returned to you. A request for voluntary suspension to suspend ASX trading has also been lodged with the ASX. The temporary suspension does not affect the distributions paid by the Fund or the investment strategy of the Fund. As more information becomes available to us, we will be in better to position to advise when liquidity is likely to be restored.

If you currently have a Distribution Reinvestment Plan in place, your future distributions will only be paid via direct credit into your nominated account and cannot be reinvested in the Fund until further notice. You will need to provide your bank account details by contacting our security registrar, Registry Direct on 1300 55 6635. Alternatively, you can provide your banking details online at www.registrydirect.com.au/investor.

Further information

If you have any queries or concerns, please contact us.

Telephone: 02 9080 2377 or 1300 553 431 (within Australia) or 0800 447 637 (within New Zealand)

Email: enquiries@aurorafunds.com.au

Post: PO Box R1695, Royal Exchange NSW 1225

- Dated 18/9/2015 – Annual Reporting and Fund Disclosure as at 30th June 2015 for the Master Fund.

Asset Allocation: 29% invested in equities & 71% invested in cash.

Liquidity Profile: 90% within 10 business and 10% within 3 months.

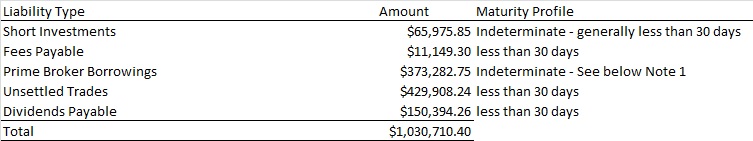

Maturity profile of the Fund’s liabilities:

Note 1 – The fund uses leverage through its Prime Broker facility with UBS AG. A maturity profile cannot be disclosed as the term of the borrowing is dependent upon portfolio construction (subject to the Prime Brokerage Agreement remaining in place.)

Leverage: N/A

Derivative Counterparties: UBS AG.

Investment Returns: +6.36% for the 2014/15 financial year.

Key Service Providers: No change

- Dated 1/7/2015 – Distribution Update

From 1 July 2015, the quarterly distribution rate for the Aurora Global Income Trust will be adjusted to 2.0% of NAV (Net Asset Value) per quarter.

- Dated 1/6/2015 – Introduction of a Performance Fee

From 1 July 2015, a performance fee equal to 20.5% per annum (including GST) of the gross performance (net of fees) over the benchmark subject to a high water market will be introduced.

- Dated 20/5/2014 – Enhancement to Investment Strategy

Aurora is pleased to notify Aurora Global Income Trust (AIB) investors of our intention to enhance the investment strategy of AIB by adding additional investment strategies to the existing earnings announcement strategy.

The existing investment strategy is market neutral global equities. This will not change. The current earnings announcement strategy will continue to be a strategy of the Trust. The additional investment strategies will include Convergence, Convertibles, Mergers & Acquisitions and Long/Short.

The Aurora investment team has a proven ability in generating consistent market neutral returns using these strategies in domestic equities and believe that this expansion will allow the trust to better achieve its overall objective of consistent non-correlated returns.

An updated Product Disclosure Statement will be issued shortly.

- Dated 2/7/2012 – GST Update

On 29 May 2012, amendments to the GST financial services regulations were released, including wide ranging new regulations relating to the reduced input tax credit treatment of supplies acquired by managed investment schemes and superannuation funds. The new rules apply from 1 July 2012.

The amendment regulations introduce a new item 32 of GST regulation 70-5.02(2) under which supplies acquired by a ‘recognised trust scheme’ on or after 1 July 2012 will be eligible for a 55% reduced input tax credit (RITC). Certain specified services will remain eligible for the 75% RITC.