The directors of the responsible entity unanimously recommend that you vote AGAINST all of the resolutions.

Read the full Explanatory Memorandum here.

You are here:

The directors of the responsible entity unanimously recommend that you vote AGAINST all of the resolutions.

Read the full Explanatory Memorandum here.

Aurora Funds Management Limited (“Aurora”) is pleased to announce that daily applications and redemptions will be reinstated for the Aurora Fortitude Absolute Return Fund and the Aurora Absolute Return Fund. The daily application and redemption facility is available from 8 September 2016.

Aurora Funds Management Limited (“Aurora”) provides the following update in respect of the Aurora Fortitude Absolute Return Fund (the “Fund”).

Antares Convertible Note Update

As at 30 June 2016, the Fund held investments in Antares Energy Limited Convertible Notes (ASX: AZZG), which had been suspended from trading on the Australian Stock Exchange on 15 September 2015 and remain suspended as at the date of this update.

In February 2016, Aurora made the decision to freeze applications and redemptions in the Fund, on the basis that it could not accurately determine a value for the AZZG Notes.

For the purposes of the June 2016 year-end financial statements, and after careful consideration of all of the available information, Aurora has formed the view that the AZZG Notes should be recognised at a nil value.

Aurora Global Income Trust update (AIB)

During the months of February and August, the majority of Australian listed companies reveal their profit results and most provide guidance as to how they expect their businesses to perform in the upcoming year. Whilst we regularly meet with companies between reporting periods to gauge how their businesses are performing, during reporting season companies open up their car bonnets to enable investors to have a detailed look at their company’s financials. Until this happens, investors don’t know for certain whether smoke is going to pour out (and receive a scornful look from the girl in red below) or find out that the growth engine is humming along.

Today marks the final day of the August 2016 reporting season and companies have until the end of the day to report their financials. In this piece we are going to run through the key themes that have emerged over the last four weeks.

Read more here.

Two weeks ago the initial public offer (IPO) of Viva Energy (a portfolio of 425 Shell service stations) listed on the ASX. This was a very successful IPO, well managed by its investment bankers who structured the deal astutely to create demand from institutional investors and the stock gained +16% on its first day of trading. Indeed the success of this IPO has prompted Woolworths to look at spinning out their portfolio of service stations into a property trust with an expected valuation between $1.3 and $1.5 billion.

We are always very sceptical about new IPOs, however occasionally a great IPO comes along, either for a long term investment or one with a high probability of making a short term gain on its opening day. In this week’s piece we are going to look at the machinations of institutional investors during the roadshow and listing of a hot IPO and the game of Liar’s Poker that goes on between fund managers and the investment banks running the IPO process.

Read more here.

Aurora Funds Management Limited (ACN 092 626 885) (Aurora) is the responsible entity of the Aurora Fortitude Absolute Return Fund (AFARF or the Fund).

On 28 July 2016, Aurora received a notice from Providence Wealth Advisory Group Pty Ltd (Providence) acting for a group of unitholders in the Fund, requesting that Aurora call a meeting of unitholders for the purpose of considering resolutions for the winding up of AFARF and the

replacement of Aurora as the responsible entity of AFARF (Requested Resolutions).

As a representative of unitholders holding more than 5% of the issued units in the Fund, Providence is entitled, under the Corporations Act 2001 (Cth), to call such a meeting. Therefore, unitholders should be aware that the Requested Resolutions are not being put to unitholders voluntarily by Aurora and have not been proposed or endorsed by Aurora.

Attached is the Notice of Meeting and Proxy Form for a meeting to consider the Requested Resolutions to take place on Monday, 26 September 2016 commencing at 11:00am at Registry Direct, Level 6, 2 Russell Street, Melbourne Vic 3000. Attachment A to the notice of meeting is

the statement provided by Providence which, in accordance with the Corporations Act, is being distributed to you at the same time as the notice of the meeting. Aurora did not prepare and is not responsible for the content of that statement which appears to contain certain misconceptions as to fees charged by the responsible entity.

We note that Aurora takes its legal and other governing obligations seriously and exercises a high level of care and prudence in relation to questions of interpretation of the Fund’s constitution and the product disclosure statement, including as it relates to fees charged by the

responsible entity.

The Board of Aurora intends to issue a more detailed Explanatory Memorandum to unitholders which will be relevant to your decision on how to vote on the Requested Resolutions. Aurora recommends that unitholders take no action in respect of the Meeting prior to receiving the Explanatory Memorandum, which will be posted to the registered address of each AFARF unitholder at least three weeks prior to the Meeting.

If you have any queries in the interim do not hesitate to contact Betty Poon by telephone +613-8687-2263.

On behalf of Aurora, thank you for your ongoing support of the Fund.

Read more here.

On Wednesday this week the Australian Bureau of Statistics (ABS) reported that inflation for the June quarter was 0.4%, down from 1% in 2015. This is watched very closely by the market, as it is a key measure used by the Reserve Bank of Australia (RBA) in making their decision on the official cash rate and increases the probability that the official rate will be cut to 1.5% in August. The benchmark Australian 10 year government bond rate, which is used as the risk free interest rate to invest in Australia, fell to 1.88% in anticipation of this further rate cut.

Low interest rates not only impact retirees looking to live of the income see Searching for Yield, but also contribute to asset price inflation. Whilst this might not be the most exciting of topics, it is important to investors, as assets from shares to real estate are currently being priced with the anticipation that historic low interest rates will continue into perpetuity! In this week’s piece we are going to look at how the steady twenty year fall in the risk-free interest rate has contributed to the asset price bubble we find ourselves in.

Read more here.

Liquidity Solution for Aurora Fortitude Absolute Return Fund

Aurora Funds Management Limited (“Aurora”) is pleased to announce some important changes to the Aurora Fortitude Absolute Return Fund (“the Fund”).

As you may be aware, on 25 February 2016, applications, redemptions and distribution reinvestments were temporarily suspended as a result of the Fund holding Convertible Notes (AZZG) issued by Antares Energy Limited (“Antares”). At the time, Antares had been suspended from trading on the ASX and as such the AZZG Notes were considered illiquid. Subsequently, on 28 April 2016, the directors of Antares placed the business into Administration with FTI Consulting ultimately being appointed as the Administrators of Antares. FTI Consulting remain in place as the Administrators today.

Since this time, Aurora has been working to deliver an equitable liquidity solution for investors.

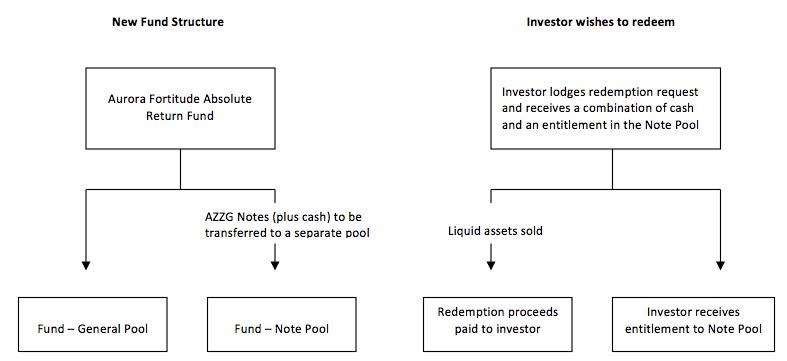

Aurora can now confirm that an off market liquidity solution will be made available for those investors wishing to redeem their investment from the Fund. Redemption requests will be satisfied by a combination of cash (approximately 90% of the investment value, based on the Fund’s current portfolio), with the balance to be satisfied from the currently illiquid portion of the Fund’s investments as and when they become liquid. To assist with transparency, the Fund will treat the illiquid component of an investor’s underlying investment in the Fund (AZZG plus a residual amount of cash to fund the associated costs) as a separate pool.

In our view, this liquidity solution results in a fair outcome for all unitholders as it provides investors with an opportunity to redeem the liquid portion of their investment whilst retaining an entitlement to the illiquid portion (which will be realised in due course). The ongoing integrity of the Fund is also preserved for remaining unitholders, and those seeking to exit the Fund will be able to receive the majority of their investment in cash.

How the liquidity solution will work

The Fund will notionally create two (2) pools, being the Aurora Fortitude Absolute Return Fund General Pool (“General Pool”) and the Aurora Fortitude Absolute Return Fund Note Pool (“Note Pool”). The illiquid investment, AZZG, will be transferred to the Note Pool along with some cash to fund the Administration, with the remaining liquid investments being held in the General Pool. All existing investors will have proportional exposure to both Pools.

Investors wishing to withdraw their investment will have redemptions satisfied by a combination of cash from the General Pool (circa 90%, based on the Fund’s current portfolio) and an entitlement to the Note Pool (circa 10%).

The Note Pool will continue to be managed by the Fund and realised over time, which is expected to be in the vicinity of 12 months (although Aurora cannot guarantee this timeframe – a significant timing issue for the Fund is the timing of reports from the Administrator of Antares to creditors, including the Fund). The Fund’s priority is to maximise returns for all investors from the AZZG position.

It is currently contemplated that Aurora will, in due course, establish a separate Special Purpose Vehicle (“SPV”), managed by Aurora, to enable the assets in the Note Pool to be transferred across to the SPV. The SPV would also be able to hold any AZZG Notes currently held by other Aurora Funds. Simultaneously, ownership of the SPV would be transferred in-specie to all unitholders, in proportion to their original investment. This would then enable each of the Aurora funds (impacted by the AZZG Notes) to be unfrozen.

This mechanism will also enable the distribution reinvestment plan to be reintroduced.

Currently, clause 7.7 of the Fund Constitution requires the Responsible Entity to cancel those Units that have been redeemed. Given the creation of two (2) Pools, the Responsible Entity has determined that the rights of unitholders would not be adversely impacted if the Constitution were to be amended to enable units in the General Pool to be cancelled, whilst units in the Note Pool remain on foot.

The current Product Disclosure Statement (“PDS”) contemplates 90% of the Fund’s assets being able to be liquidated within 10 business days. To facilitate the normal functioning of the Fund, whilst the Note Pool is in place, the Fund will revert to the liquidity requirements contained in its Constitution, which is consistent with the Corporations Act.

The PDS will also be amended to make it clear to all new unitholders that any new investment will only have an entitlement to the General Pool.

The Responsible Entity is of the opinion that the creation of two (2) Pools, and establishment of the SPV in due course, will enable existing unitholders to ultimately maximise their investment returns. To facilitate this change to the Fund structure, the Responsible Entity has decided to exercise its power under the Fund’s Constitution to introduce a withdrawal fee equal to 1.85%, excluding any GST, of the redemption amount.

The team at Aurora welcome the resolution of the liquidity situation. With this impediment now removed, we look forward to continuing our strong track record of generating risk-adjusted returns for our investors.

Timetable

Redemption requests can now be submitted immediately, with redemptions to be processed on the last business day of each calendar month, pursuant to the Fund’s Constitution. Due to financial year-end, the next redemption day will be Wednesday 31 August 2016, with proceeds from a redemption request likely to be received within 14 business days thereafter.

What to do if you wish to remain invested in the Fund

If you wish to remain invested in the Fund, you don’t need to do anything. Your investment will continue to:

What to do if you wish redeem

Should you wish to withdraw part or all of your investment, you will need to:

The unit registry, One Registry Services will send you a confirmation of your redemption and your entitlement to the Note Pool (including the per Unit value of the net asset value of the Note Pool shown in the latest audited accounts of the Fund). You should keep this documentation for your records. One Registry Services can be contacted on (02) 8188 1510.

A print version is available here.

The world is in a period of low growth and political uncertainty (Brexit, Hung Parliaments, Donald Trump etc). Property as an investment class has performed well in this environment and is expected to continue to do so with lower interest rates and the largesse of central banks continuing to pour fuel on the fire. Quality, as an investment style, is also expected to outperform during periods of uncertainty see our note Investment Philosophies. During turbulent times, investor’s risk appetite reduces sharply and companies that were previously perceived to be “boring” become favoured by investors for their stable earnings, dividends and conservative balance sheets.

Currently the official cash rate in Australia is 1.75% and we are expecting a further cut in August 2016 to 1.5%. This will likely push the benchmark 1 year term deposit rate below 2%, which will further ratchet up the pressure on retirees requiring income that don’t enjoy baked beans on toast with the frequency that small children do! In this piece we are going to look at the buy-write strategy of enhancing income in a portfolio and how this strategy performs during periods of low growth and uncertainty.

Read more here.

The last six months have been stressful for Australian equity investors and despite the ASX200 delivering a total return of 1.1% (capital appreciation plus dividends), it has been an emotional rollercoaster. December’s Santa Claus rally turned into a brutal hangover in the New Year, similar to that given by excessive consumption of four litre cask white wine from Southern Queensland. The market then staged a recovery in March and May, before falling in a heap in June due to the surprising outcome of UK vote to leave the European Union.

In this week’s piece we are going to look at what has happened over the first half of the year, some key themes and analyse the catalysts that contributed to the top and bottom performers.

Read more here.

Receive the latest investment funds news from Aurora delivered right to your inbox

SIGN UP HERE